How Much Does It Cost Cpa Firms To Register With New York Board Of Education

New York CPA Exam

New York CPA (Certified Public Accountant) License is an official accounting certification compulsory to work as a CPA in the U.S. province. New York renders the CPA License to professionals complying with its exam, education, and experience requirements. Being the U.South. financial hub, opportunities abound for licensed accounting professionals in the state.

You are gratis to use this image on your website, templates etc, Please provide us with an attribution link Commodity Link to be Hyperlinked

For eg:

Source: New York CPA Exam and License Requirements (wallstreetmojo.com)

The Empire Country administers a one-tier licensing strategy. Therefore, y'all would be certified and licensed simultaneously after passing the CPA Exam A Certified Public Accountant (CPA) is a United states of america state board-issued license to practise the bookkeeping profession read more and coming together other qualifications. Note that the New York State Department of Pedagogy (NYSED) is the sole authority for CPA licensing in the state.

The U.S. jurisdiction conducts the CPA Test at international locations likewise. Here is an outline of the New York CPA exam and license requirements.

| Particulars | New York CPA Exam Requirements | New York CPA License Requirements |

| Minimum Age | 21 | 21 |

| U.South. Citizenship & Residency | Not Required | Non Required |

| Social Security Number | Not Required | Not Required |

| Education | 120 semester hours/150 semester hours/15 years public accounting experience | 150 semester hours |

| Exam | Schedule and take all sections within 18 months | Laissez passer all four test sections with 75 points in each |

| Experience | – | 1 or 2 years |

| Ideals Examination | – | None |

Contents

New York CPA Exam Requirements

- Eligibility Requirements

- Fees

- Required Documents

New York CPA License Requisites

- Educational activity Requirements

- Test Requirements

- Experience Requirements

Standing Professional Educational activity (CPE)

New York Examination Information & Resources

New York CPA Exam Requirements

The Uniform CPA Examination is a multi-part estimator-assisted test. It evaluates the candidate's potential to pursue public accounting in the U.South. It is considered one of the near challenging professional exams.

It is adult and graded past the American Institute of Certified Public Accountants (AICPA) in co-operation with the National Clan of Land Boards of Public Accountancy (NASBA).

The four CPA examination sections The Uniform Certified Public Accountant (CPA) Exam comprises iv sections, namely, Auditing and Attestation (AUD), Business Surround and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). The unique content, construction, format, and scoring of the CPA exam earn it the championship of one of the most challenging professional exams. read more than are Business Environs & Concepts (BEC Exam The BEC CPA Examination (Business Environment and Concepts) test department evaluates your agreement of the general business environment and your duties and responsibilities as a CPA towards it. It assesses your power to recognize and scrutinize situations related to Financial reporting, Financial argument inspect and attestation and Revenue enhancement grooming read more ), Regulation (REG Exam REG CPA Exam (Regulation) exam section tests a candidate's competency in applying the concepts of federal tax, business police force, and ethics. It is a four-hour exam with fifteen minutes break. read more ), Financial Accounting & Reporting (FAR exam The Financial Accounting and Reporting (FAR) CPA Exam section tests a candidate'due south competency in understanding and applying fiscal accounting and reporting standards. read more ), and Auditing & Attestation (AUD Exam Auditing and Testament (AUD) is i of the four Uniform Certified Public Auditor (CPA) Examination sections to exist passed for CPA licensure. With a circuitous examination format, tricky questions, and an exhaustive list of topics to written report, you will do good from some quick tips on the art of preparing for the AUD CPA test section. read more ). Each examination part is four-hour long. Information technology encompasses five testlets featuring iii question types.

Multiple-selection questions (MCQs) and chore-based simulations (TBSs) are included in all sections. At the aforementioned time, written communication tasks (WCTs) are only covered in the BEC section.

Please note that you lot have a rolling 18-month window to pass all four sections successfully. Ensure to score at least 75 points on a scale of 0-99 in each part.

| Particulars | Details | |

| Exam Awarding Regulatory Torso | CPAES | |

| Passing Score | Minimum 75 points in each section | |

| Exam Sections | four | |

| Timeframe | 18-month rolling period | |

| Examination Duration | 16-hour (4-hour per section) | |

| Test Regulators | AICPA, NASBA, & Prometric | |

| Required Documents | Official School Transcript(s) | |

| Strange Evaluation Report with Foreign Documents | ||

| NY Country Registered Plan Form | ||

| Testing Accommodations Request Class | ||

| Fees | Initial applicants | $1070 approx. |

| Re-test applicants | $310-$985 approx. (as per the number of sections to re-take) | |

| Eligibility Requirements | 120 semester hours | |

| 150 semester hours, or | ||

| xv-year public accounting experience | ||

Best CPA Review

Surgent CPA Review

350 Videosrn7,700 QuestionsrnFree Trial

Becker CPA Review

500+ Videosrn9,200 QuestionsrnFree Trial

![]()

Universal CPA Review

250+ hrs Videosrn9,200+ QuestionrnFree Trial

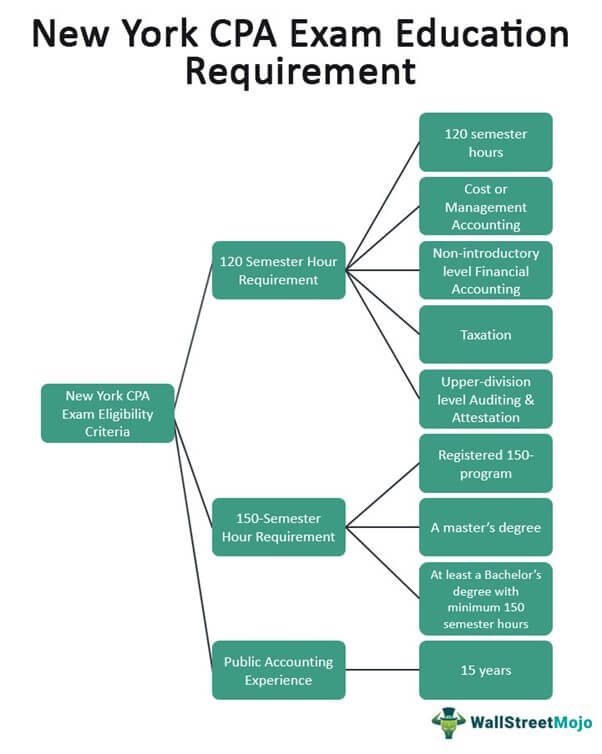

Eligibility Requirements

New York CPA License candidates planning to sit for the test must take one of the following requirement pathways:

- 120 semester hr pathway

- 150 semester 60 minutes pathway

- 15 years public accounting experience pathway

The details are as follows:

| Particulars | 120 Semester Hour Pathway | 150 Semester 60 minutes Pathway | Public Accounting Experience Pathway | |

| Atmospheric condition | Candidates who practical for CPA licensure or completed the required education before August i, 2009, must satisfy one of the post-obit options: | Candidates who did not use for CPA licensure or who completed the required education after August one, 2009, must fulfill each of the following prerequisites: | Candidates who applied for CPA licensure or completed the required education afterwards August 1, 2009, with 150 semester hours, must see one of the following: | Proceeds 15 years of land-lath approved public bookkeeping feel. |

| Option 1 | Consummate the registered 120-hour plan authorized by NYSED (reviewed by CPAES) |

| Consummate the registered 150-60 minutes program authorized past NYSED (reviewed by CPAES) | – |

| Option 2 | Agree a bachelor'south caste with an accounting major from a higher or university approved by the Clan to Accelerate Collegiate Schools of Business (AACSB) | – | Concord a master'southward caste with an accounting major from a college or university approved by the AACSB | – |

| Option iii | Concord at least a bachelor's degree and a minimum of 120 semester hours in the following areas: | – | Concur at least a available's degree with a minimum of 150 semester hours (225 quarter hours) in college-level didactics, including | |

24 semester hours in accounting with:

| ||||

33 semester hours (49.5 quarter hours) in accounting with:

| ||||

21 semester hours in business and accounting,

| ||||

| 36 semester (54 quarter) hours in general business | ||||

Note that yous must as well embrace Communications and Ethics & Responsibilities subjects in either business organization or accounting. Also, the public accounting experience must see the following requisites:

- A U.South. CPA or New York Public Auditor (PA) must directly supervise the experience.

- Information technology must involve the implementation of U.Due south. Generally Accepted Accounting Principles (GAAP) and Generally Accepted Bookkeeping Standards (GAAS). Besides, it must include the training of auditing & financial statements.

- The supervising CPA must submit the Verification of Experience Form to the NYSED.

You are free to employ this prototype on your website, templates etc, Please provide united states of america with an attribution link Article Link to be Hyperlinked

For eg:

Source: New York CPA Exam and License Requirements (wallstreetmojo.com)

On coming together all requisites, submit the online awarding, fees, and documents to CPA Examination Services (CPAES). For the complete procedure, kindly visit the NASBA portal.

NASBA Advisory Evaluation service is also available to determine any educational flaws in your documents before the final submission.

Fees

Initial examination candidates:

| Particulars | Examination Fees | Full Fees |

| Awarding Fee | – | $170 |

| Registration Fee | – | – |

| Exam sections | – | – |

| AUD | $224.99 | – |

| BEC | $224.99 | – |

| FAR | $224.99 | – |

| REG | $224.99 | $899.96 |

| Total Fees | $899.96 | $1069.96 |

Re-test candidates:

| CPA Exam Sections | Exam Fees (per department) | Total Test Fees (all sections) | Awarding Fees | Full Fees |

| 4 exam sections | $224.99 | $899.96 | $85 | $984.96 |

| 3 exam sections | $224.99 | $674.97 | $85 | $759.97 |

| 2 exam sections | $224.99 | $449.98 | $85 | $534.98 |

| one exam sections | $224.99 | $224.99 | $85 | $309.99 |

New York CPA aspirants can't withdraw from the licensure test or request to extend their Notice-to-Schedule (NTS). However, they may receive a partial examination fees reimbursement or request an NTS extension nether drastic scenarios.

Both examination and awarding fees are non-refundable. Then, just sign up for the section(due south) that you can have upward in the six-month NTS validity period.

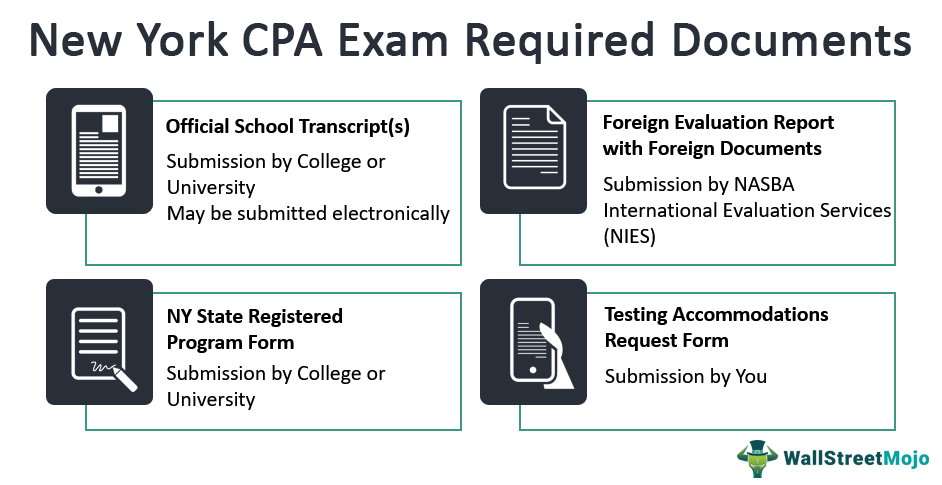

Required Documents

Below-mentioned is the checklist for required documents.

You are costless to employ this image on your website, templates etc, Please provide u.s.a. with an attribution link Commodity Link to be Hyperlinked

For eg:

Source: New York CPA Exam and License Requirements (wallstreetmojo.com)

Please note that only original transcripts are official and adequate.

New York CPA License Requisites

Now that we have elaborated on the exam requirements, let's move on to the prerequisites for a New York CPA License. They are as follows:

- Prove good moral character

- Be a minimum of 21 years of historic period

- Consummate 150 semester hours

- Pass each of the 4 CPA exam sections

- Obtain 1 or 2 years of relevant piece of work feel

Delight annotation that Social Security Number (SSN) is used, yet not mandatory, for CPA applicants. Moreover, CPAES assigns a unique computer-generated number for applicants without SSN.

Apply for the CPA License through NYSED along with the required forms. Please cheque the official website for the consummate procedure.

| Required Forms | Services |

| Grade 1 | Application for Licensure & Fees ($427) |

| Grade 2 | Certification of Professional Education |

| Form three | Certification of Out-Of-Country Licensure and Examination Grades |

| Form 4B | Verification of Experience by Supervisor |

Know that the licensure fees are field of study to change. Hence, check with the NYSED before final submission.

Education Requirements

New York CPA aspirants tin can complete their education requisites through one of the 2 pathways:

#1 – 150 Semester Hour Pathway

The required hours must be obtained from i of these programs:

- NY State Licensure Qualifying Registered Programs – Consummate an bookkeeping program registered by the NYSED as licensure-qualifying.

- AACSB Programs – Complete a master'due south caste in accounting from an AACSB institute accredited in business and accounting.

- All other Programs – Consummate a postsecondary education regarded to exist substantially equivalent to the programs registered with the NYSED. It includes a minimum of a bachelor's caste from an accredited institute by NYSED-approved agencies.

Notation that the 150 semester hours must include:

- 33 semester hours in accounting with at least one course in the start iv listed subjects:

- Financial Bookkeeping & Reporting

- Toll or Managerial Accounting

- Taxation

- Auditing & Attestation Services

- Fraud Test

- Internal Controls & Run a risk Assessment

- Accounting Data Systems

- 36 semester hours in general concern electives in any combination of the post-obit subjects:

- Business organisation Statistics

- Figurer Science

- Finance

- Marketing

- Organizational Behavior

- Quantitative Methods

- Business Law

- Economics

- Management

- Operations Management Operations management is a business surface area that implements practices ensuring the conversion of inputs into goods and services with maximum efficiency. read more

- Business Strategy

- It & Systems

The subjects must also contain business organisation or accounting communications, accounting research, and ethics & professional responsibleness every bit stand up-solitary or integrated courses.

#2 – 120 Semester Hr Pathway

The following candidates can apply through the 120-hour pathway:

- Candidates who are not licensed in another state and have applied for licensure past finishing their pedagogy before Baronial one, 2009. Such candidates are deemed grandparented into the 120 semester 60 minutes pathway.

- Candidates who were licensed in another country before Baronial 2009 just did not accept four years of experience in the preceding ten years.

Candidates eligible for grandparenting may complete additional coursework and become their education re-evaluated to employ through the 150 semester hour pathway.

Exam Requirements

NY CPA aspirants must score 75 points or more in each of the iv CPA Exam sections. Delight note that you take a rolling eighteen-month period to conclude the licensure test. Refer to the New York Exam Requirements section for more details.

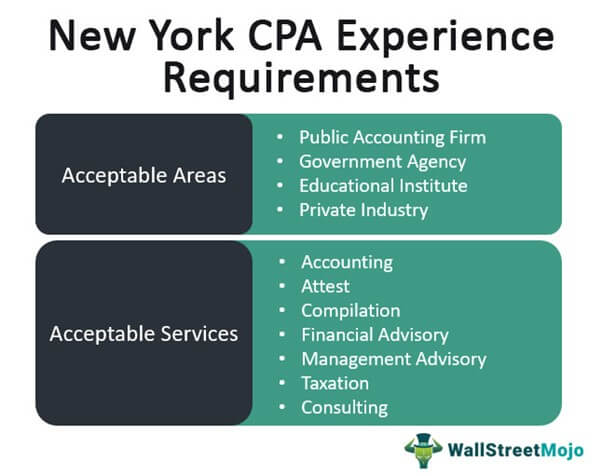

Feel Requirements

The following are the experience requisites:

- 120 semester hr pathway applicants – Proceeds at least two years of part-time or total-time work experience.

- 150 semester 60 minutes pathway applicants – Obtain one twelvemonth of office-time or full-fourth dimension work feel.

An active CPA from the same organization must supervise your employment and submit the Verification of Experience Class.

You are free to use this paradigm on your website, templates etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: New York CPA Exam and License Requirements (wallstreetmojo.com)

The required experience may be full-time or part-time:

- Total-time employment – Minimum 35 hours per week (5-day piece of work week)

- Part-time work feel – 20 hours per calendar week (Ii part-fourth dimension weeks constitute 1 full-fourth dimension week)

A candidate who takes the fifteen years of experience pathway to meet the education requirements need non get any other feel for licensure after passing the exam.

Continuing Professional Educational activity (CPE)

New York Country CPAs must earn the required CPE credit hours annually. Courses taken within the land must be sponsored past firms registered with NASBA or the NY land board.

On the other hand, courses taken outside the land must exist sponsored by firms registered with NY country board, NASBA, or the state board in which the form was taken.

Here is everything you lot must know well-nigh the CPE requirements.

| Particulars | Details | ||

| Date for Renewing License | Triennial based on the issuance date (electric current) & nascency month (before Jan i, 1993) | ||

| Reporting Period for CPE | January one-December 31 (Annually) | ||

| Full general CPE Requirement | Recognized subject area areas | Accounting | |

| Attest | |||

| Auditing | |||

| Taxation | |||

| Advisory Services | |||

| Specialized knowledge & applications associated with specialized industries | |||

| Areas adequately associated with the accounting practice | |||

| Hours in whatsoever of the recognized subject area areas | Minimum xl contact hours | ||

| Hours in one recognized field of study | Minimum 24 contact hours | ||

| Ideals Requirement | Professional Ethics | 4 hours during the 3 calendar years before the licensure expiration date | |

| 4 hours are acceptable toward the almanac contact 60 minutes requirement in the calendar twelvemonth that they are taken | |||

| If the Principal Place of business is New York | State-approved Ethics course | ||

| If the Principal Place of business concern is New York | Regulatory Ethics earned from the NASBA, respective land board, or NY Land Board-approved provider | ||

| Other Subject Area Requirements | Inspect, Accounting, &/or Attest | Minimum 40 contact hours during the 3 years immediately before performing inspect/adjure services | |

| Information technology may be counted toward the annual contact hr requisite in the calendar twelvemonth that they are earned | |||

| Credit Limitations | Education | Maximum 50% of total hours | |

| Published Materials | Maximum 50% of total hours | ||

| Other Land Policies | Form Provider | Courses taken in New York | Sponsored by entities registered with NY State Board or with NASBA |

| Courses taken outside New York | Sponsored by entities registered with NY Country Board, with NASBA, or the respective State Lath | ||

| Self-Study Courses | Sponsored by entities registered with NY Country Board or with NASBA (irrespective of physical location) | ||

| Professional evolution programs & technical sessions of local, national, & state firms & organizations in board-canonical public accounting exercise | |||

| Other organized technical & educational programs relevant to the board-canonical public accounting practice | |||

As per NYSED, there are a full of 44,190 CPAs in the land. The New York City itself houses almost 7000 CPAs. Too, there are over 2500 CPA licenses issued annually in the province inside the past four calendar years (2016-2020).

When it comes to New York and CPA, you simply can't deny the relevance of Wall Street. The home of the New York Country Exchange is a haven for several accountants. So, in a metropolis that never sleeps, CPAs tin thrive like never before.

Hence, gear up to earn this coveted title in 1 of the most lively and various places across the continent! Keep yourself updated with all the CPA exam and license requirements through the authorized websites of AICPA, NASBA, and the New York country board. Learn more near CPEs for CPA As a Certified Public Accountant (CPA), you demand to acquire Continuing Professional Educational activity or CPE credits for sustaining your license. This ensures that you lot are actively involved in improving your know-how of the profession past engaging in learning activities. read more

New York Exam & Information Resource

1. New York State Department of Education (http://www.nysed.gov/)

New York State Education Building

89 Washington Avenue

Albany, NY 12234

2. New York State Society of CPA (https://www.nysscpa.org/)

14 Wall Street

19th Floor

New York, NY 10005

Telephone: 800-537-3635

Fax: 866-495-1354

3. NASBA (https://nasba.org/)

150 Quaternary Ave. North

Suite 700

Nashville, TN 37219-2417

Tel: 615-880-4200

Fax: 615-880-4290

CPAES

800-272-3926

International: 615-880-4250

[email protected]

4. AICPA (https://www.aicpa.org/)

1345 Avenue of the Americas, 27th Floor

New York, NY 10105

P: +ane.212.596.6200

F: +1.212.596.6213

Recommended Articles

A Guide to New York CPA Exam & License Requirements. Hither we talk over all the prerequisites to the New York CPA exam and license. You may likewise take a wait at the below articles to compare CPA with other examinations –

- Minnesota CPA Exam Minnesota CPA (Certified Public Accountant) License is a legal permit bestowed on qualified accountants to practice the profession in the land. With its potent economy and bright business outlook, Minnesota offers a rewarding career to professionals armed with a CPA license. And so, to acquire the license and savor a fulfilling career, Minnesota CPA candidates must observe the country-specific protocols for examination, education, and other requirements. read more

- Texas CPA Test Texas CPA (Certified Public Accountant) License is a statutory title granted to qualified accountants to pursue the profession in the U.S. jurisdiction. Texas has specific standards with regard to exam, feel, and other requirements to successfully learn the CPA license. read more

- Illinois CPA Test Illinois CPA (Certified Public Auditor) License is a country-board issued accounting credential offered in the State of Lincoln. The state mandates the Illinois Board of Examiners (ILBOE) to lay down the instruction, exam, and other requirements to larn the CPA license. read more

How Much Does It Cost Cpa Firms To Register With New York Board Of Education,

Source: https://www.wallstreetmojo.com/new-york-cpa-exam-and-license-requirements/

Posted by: pendletonplebadve.blogspot.com

0 Response to "How Much Does It Cost Cpa Firms To Register With New York Board Of Education"

Post a Comment